By Judy Bellack, Chief Consultant, Judith Lawrence Associates

For many renters, pets are family. Yet in the rental housing industry, pet fees, deposits, and pet rent have become standard costs for pet owners. While these charges are often justified as necessary to cover potential damages, the reality is that many housing providers have turned pet fees into a significant revenue stream. This raises an important question: Are pet fees truly about cost recovery, or have they evolved into an unfair financial burden, particularly for lower-income renters?

Breaking Down the Math: Pet Fees as a Revenue Stream

Revenue from Pet Fees

To illustrate the financial impact, let’s consider a hypothetical property management company overseeing 10,000 rental units. If the company charges a $300 non-refundable pet fee per pet and collects $50 per month in pet rent, here’s what the annual revenue could look like:

- One-time pet fees: Assuming 30% of the units (3,000) house a pet, the company collects $900,000 in non-refundable pet fees upfront ($300 x 3,000 = $900,000).

- Monthly pet rent: If 3,000 renters pay $50 per month in pet rent, that’s $150,000 per month or $1.8 million per year.

- Total annual revenue from pet fees and rent: $2.7 million

Pet-Related Costs

Now, let’s compare this to the actual costs associated with pet-related damages and basic pet amenities:

- Industry data suggests that pet-related damages average between $210-$600 per unit per lease term, with many pet-owning residents leaving apartments in similar condition to non-pet owners. If we estimate an average pet-related damage cost of $400 per unit for 50% turnover of those same 3,000 units, that results in a total expense of $600,000. And this is estimating on the high side, as not every unit will experience pet damage.

- Assuming a deep clean is performed on a vacated pet unit to remove allergens, this would average an additional $150 per unit for 50% of 3000 units, or $225,000 over the course of a year.

- Pet waste stations, including dispensers and biodegradable bags, typically cost around $75 per unit per year, totaling approximately $225,000 annually.

- Maintaining a small on-site dog park with artificial turf can require ongoing upkeep costs of $5,000 per year for sanitation and turf repairs. Let’s assume 12 parks covering 3000 units (average 250-unit properties), for a total of $60,000 per year. Let’s round that up to $100,000 to be generous.

- Total annual costs of having pets on site: $1.150 million

The result? Even after accounting for damages, the company nets $1.550 million in excess revenue from pet fees. This discrepancy underscores the fact that pet fees have far outpaced actual expenses, turning them into a profit center in addition to a cost-recovery mechanism.

The Impact on Renters and Equity Concerns

For many renters, particularly those in lower-income brackets, these additional fees present a significant financial hurdle. A pet owner in a $1,500/month apartment could be paying upwards of $900 per year in pet-related fees—on top of the deposit and regular rent. This cost burden disproportionately affects renters who may already struggle to afford housing. It could potentially force them to choose between keeping a beloved pet and securing a home.

Moreover, these fees may discourage engaged pet ownership or push renters toward housing options that are less secure or even pet-restrictive. Given that many pet owners view their animals as family, the financial penalties imposed by pet fees could be seen as punitive rather than protective.

Transparency is Critical

If rental housing operators continue to charge pet fees, transparency is key. Instead of presenting pet fees as a catch-all cost, property managers should clearly communicate how these fees benefit both the community and pet owners. Possible benefits include:

- Pet-friendly amenities: If a community offers pet waste stations, dog parks, or pet washing stations, pet fees may contribute to these enhancements.

- Cleaning and maintenance: If fees are used to address additional cleaning or repair needs, operators should highlight these measures.

- Insurance or liability coverage: Some fees contribute to insurance costs related to pet ownership within rental properties.

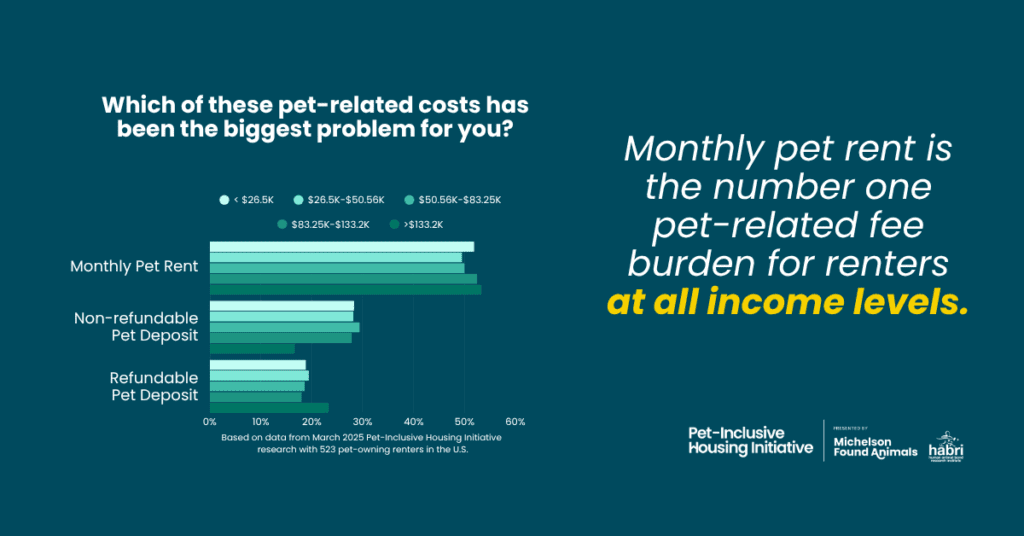

By providing transparency and ensuring fees are aligned with actual costs, housing providers can build goodwill with pet owners while maintaining fair revenue practices. Also, consider renter attitudes toward the type of pet fees charged. For example, research indicates that renters at all income levels find monthly pet rent the most problematic.

Conclusion

Pet fees in rental housing have evolved beyond simple cost recovery, becoming a revenue source – and burdensome for many pet owners. While it’s reasonable for property managers to mitigate risk and cover actual damages, the current fee structures often far exceed these costs. Ensuring that any pet-related fees are fair, transparent, and aligned with actual expenses can create a more equitable landscape for renters and their pets alike. After all, a truly pet-inclusive community should welcome engaged pet owners, not financially penalize them.

Rethinking pet fees and finding fairness for renters and housing providers is possible. Visit petsandhousing.org to learn more.